Recent research has shown there is a commonly held view that managed accounts are more suited to High Net Worth clients. However, with more advisers starting to embrace managed accounts as a whole-of-practice solution, these myths are now being disproved, demonstrating that clients of any portfolio size can benefit from a managed accounts approach.

Myth 1 – Managed accounts are too expensive for low-balance clients

Managed accounts have the potential to offer a cost-efficient solution for all clients, but it will depend on the combination of the chosen model manager and the managed account platform used to deploy the model. Overall portfolio management fees are typically lower with a managed account, due to the reduced trade execution, netting benefits, and custody costs inherent within the model structure. This is why we are seeing traditional Managed Fund providers shift their focus to SMAs due to the outsourced custody and trading benefits leading to a reduced portfolio Management Expense Ratio (MER). Therefore, portfolio costs alone can make the overall proposition very compelling.

When it comes to cost, not all platforms are the same. In addition to the cost of platform administration fees, it is important to understand the impact that trading costs and netting have on returns. There can be wide variances in the cost of trading between platforms that could erode the cost benefits to smaller clients. Platforms adopt different approaches to passing on the netting benefit to investors. For example, Praemium nets trades at a scheme level and passes these benefits directly to the client in the form of reduced costs. Undertaking some further research will help identify the true cost of the SMA.

Myth 2 – Managed accounts are too complicated to explain to less sophisticated clients

While managed accounts may not be as commonly known by retail investors as managed funds are, the process for recommending this solution is not dissimilar. Many SMA models are also fully diversified with either a goal (CPI) or risk-based strategy, allowing advisers to recommend one model rather than a suite of individual managed funds, making it much simpler for clients to understand.

Managed account portfolios can also include ETFs or managed funds which can simplify the portfolio construction or stock selection recommendation discussion with clients.

Focusing on the benefits of managed accounts; diversification of investments, beneficial ownership and transparency are things that all investors appreciate and are relatively easy to explain in the context of a managed account.

Utilising managed accounts offers a great opportunity to engage with your clients and demonstrate the value you add as their adviser. Presenting them with a new investment opportunity and explaining the benefits managed accounts offer, can showcase your expertise and give your clients an insight into the higher levels of engagement they can receive through a managed accounts approach.

Myth 3 – Detailed reporting of managed accounts is overwhelming for the average investor

Choosing the right technology partner will allow you to tailor reporting to your client’s information needs, whether that is via highly detailed reports or a more visual summary of their portfolio’s highlights. With the growth in client-focused technology providers and platforms developing more client engagement tools, it is now much easier for advisers to build different engagement experiences across different segments of a client base.

Younger investors, in particular, are becoming more discerning about the stocks held in their portfolio, demonstrated by the marked increase in ESG investing by this generation. Being able to provide reporting with this level of detail and transparency will become increasingly important to this client segment.

Regardless of whether your client has basic investment knowledge or is a sophisticated investor, reports can be customised to deliver the level of information most suited to their requirements and level of understanding. Investor Portals, like Praemium’s, can give investors 24/7 access to see their portfolio and the reports you publish directly to their account login. This transparency of information is highly valued by investors and often cited as a key benefit to clients using managed accounts. It also allows your client meetings to become more focused on strategy and goal achievement, rather than providing a portfolio update.

Myth 4 – Managed accounts is a one-size-fits-all approach that isn’t right for all my clients

While a managed account solution effectively outsources stock selection and many time-consuming administrative duties, that doesn’t put an end to the value an adviser can add to their clients’ portfolios.

Using account customisations, a portfolio can be tailored specifically for a client by:

- removing, substituting or holding particular securities

- screening for ethical considerations, and

- adding additional single investments to the portfolio to create a more Individually Managed Account (IMA) experience.

Therefore, it is possible for a practice to have an underlying investment philosophy and execute that philosophy using a set of managed account model portfolios. Dependent on the complexity of the client’s needs or their desire to have a more bespoke experience, the adviser can use account customisation functionality to create a more personalised portfolio whilst still minimising portfolio administration.

With a range of managed accounts covering custody and non-custody investments and the functionality to screen stocks based on ethical considerations, advisers can create a managed account solution to suit a range of client types and portfolio sizes.

Reaping the benefits with a whole of practice approach

Research shows that advice firms who are embracing managed accounts as a whole of practice solution are really seeing the benefits.

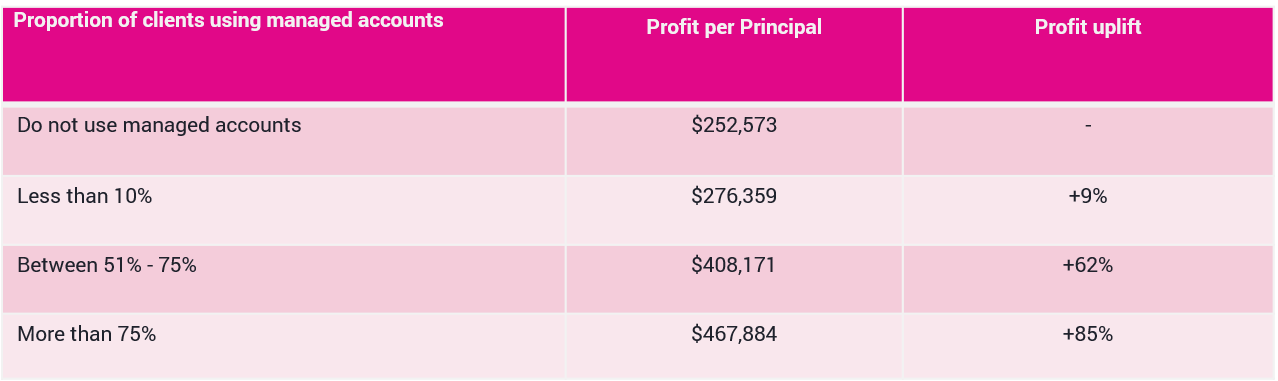

Almost a third (31%) of the managed account firms surveyed by Business Health, now manage all of their clients’ portfolios through a managed account structure. These firms demonstrated that embedding managed accounts as a whole of practice solution, rather than discriminating based on portfolio size, delivered a significant improvement in profitability. Firms using managed accounts for more than 75% of their clients saw a profit uplift of over 85%, compared to firms who don’t use managed accounts at all.

Source: The real truth about managed accounts September 2019. Business Health and Praemium

Managed accounts offer many benefits that make them suitable for a wide range of investors, regardless of their portfolio’s market value. Making the decision to embrace managed accounts as a whole of practice solution can enhance client engagement, help to provide a tailored service to all clients and deliver a significant profitability boost to practices.