Over 2024, Emerging Markets (EM) were driven higher by the AI trade causing a marked rally in North Asia’s IT and chip manufacturing stocks. Easing financial conditions due to lower inflation and subsequent central bank rate cuts have also created a favourable environment for equities.

On the other hand, the announcement of a new stimulus package by People’s Republic of China (PBoC) intended to stem continued deleveraging and weak consumer sentiment in China, and major elections in key EMs like India, Indonesia and Mexico have driven volatility in the EM benchmark.

Central bank policy weighs heavily on global growth outlook, an EM catalyst

The global economy has remained surprisingly resilient over the past 12 months as global inflation has eased from a peak of 9.4% in late 2022 to much lower levels in response to higher policy rates over the 2022-2023 period. Indeed, the IMF now expects global growth to stabilise at 3.2% for 2025, which would be the weakest growth rate in a decade.

Slowing inflation and softer-than-expected growth could precipitate further central bank easing – following the initial 50bps cut from the US Federal Reserve in September. EM real rates are already high, which gives EM central banks more flexibility to cut rates into 2025.

Past periods of coordinated global central bank monetary easing have acted as positive catalyst for capital flows into the EM asset class, as investors ‘de-dollarise’ their portfolios and take on more risk.

The best companies, in the best sovereigns

The EM equity asset class is not homogenous, and as always, the risk profiles vary considerably across country, sector, and company. At a high level we want to invest in Emerging Markets with strong demographics. Essentially countries with large, young populations fuelling growth in the volume of working people, household formation and associated salary mass and/or improving workforce productivity.

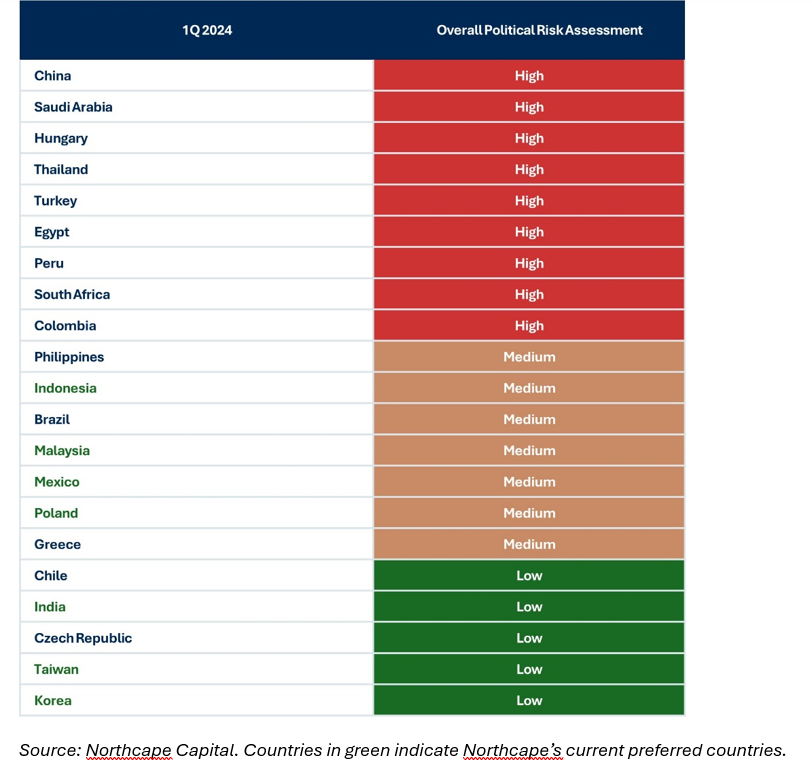

A focus on strong governance in assessing sovereign risk is also critical. We place a large premium on democratic countries with independent judiciaries allowing corporate law to be prosecuted effectively. We also want to see freedom of assembly and press, independent central banks, and responsible fiscal, human rights, and environmental policies.

Taken together these provide the crucial checks and balances for capital markets to function with integrity. When these factors are absent, capital loss risks become very high and almost inevitable over time – witness Russia. Through this lens, our current preferred sovereigns are India, South Korea, Taiwan, Poland, Malaysia and Indonesia due to demographics, better governance practices and capital market buffers.

Political and Governance Risk Factors - Global Emerging Markets

Key themes to look out for in 2025…

We continue to favour sectors with structural growth such as information technology, banks and financials, telecoms, consumer, and infrastructure. These tend to grow at the rate of GDP (or even higher) but with relatively lower volatility.

Industry consolidation, driving increased pricing power and higher ROEs for industry leaders

In our view the days of zero interest rates (free money) are gone for a few years at least, which will place limits on the supply of capital to start-ups and/or businesses with negative free cashflows. This is especially the case in EM where interest rates are generally higher than in US, Europe and Japan.

This will enhance the competitive position of leading EM companies which have strong cashflows and fully funded business models. These leaders are now in a good position to grow their market share by reinvesting in their business at a higher rate than their poorly funded competitors, which will increasingly become locked out of capital markets.

This should drive industry consolidation, raise sector barriers to entry and improve pricing power and returns on capital for the market leaders. Note that currently 80% of the total portfolio weighting comprises companies which are the number 1 operator by market share in their respective industry.

AI benefiting North Asia semi-industry for many years

We believe the North Asian semiconductor stocks are well placed to benefit as mission critical suppliers of AI semiconductor chips. TSMC is the undisputed leader in logic chips, with only one main foundry competitor, Samsung Electronics. TSMC will also likely continue to take market share from Intel, due to the fact it has superior logic chip technology, supported by its unmatched R&D and operating scale. Indeed, it is possible over the long run Intel may abandon its logic chip making and outsource to TSMC. Samsung Electronics and SK Hynix, likewise, will continue to benefit from the AI boom.

Supply Chain Relocation from China

The COVID pandemic was a seminal event in which companies recognised the fragilities of having their supply chains overly exposed to China. This coupled with the economic, investment and trade ‘divorce’ between the US and China, means we are in the midst of a shift to more distributed global supply chains, which are much less dependent on any one country. In our view the key beneficiaries of the redistribution of supply chains from China will be Vietnam, Malaysia, Indonesia, India, and Mexico. This will assist technology transfer and growth of these countries and act as a further constraint on China’s growth. India, Indonesia and Mexico are key overweight positions in the portfolio, while China is a deep underweight.

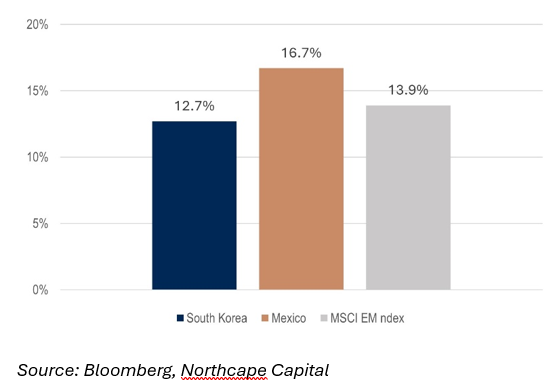

South Korea Return on Equity highlights the potential valuation re-rating

South Korea’s “Value-Up” program was launched in February 2024 with the objective of enhancing corporate governance and market practices to increase shareholder value by aligning the interests of controlling and minority shareholders. If successful, the Korean Value-Up initiative could drive a material re-rating in the valuation multiples for Korean companies.

Return on Equity

We believe that Korea’s Value-Up program holds significant promise for enhancing corporate value and improving investment returns over the long-run. However, it will take time, and its success hinges on overcoming resistance from business interests, maintaining momentum amidst a messy political backdrop, and likely requires stronger enforcement mechanisms.

Cautious outlook for China

We remain very cautious on China due to excessive debt, poor governance, and challenged demographics. We continue to identify risks to the downside on China relative to our preferred EMs.

The largest immediate risk to China’s capital markets continues to be the ongoing demise of the property sector which accounts for about 30% of GDP. This has negative consequences for the country’s economic growth, and there are contagion risks from property price weakness to the solvency of the banking system, given property linked debt is close to 70% of China’s GDP.

China’s market has recovered recently driven by the announcement of monetary and fiscal interventions introduced to prop up the weakening economy. We note that the stimulus measures announced by China are quite modest by historic standards (~3% of GDP vs. ~12% in 2008).

We have observed this type of stock market reaction before when stimulus is injected into the economy, and the current situation is no exception. Similar reactions occurred in 2009, 2015, 2017 and 2020 when the government infused funds into capital markets. In fact, in four of the past five rallies in China since 2005, three were driven by stimulus. However, these rallies were typically very short-lived, as PBoC stimulus alone was insufficient to sustain long-term share price performance. Deeper issues remain unaddressed.

These deep structural problems, compounded by an overreliance on stimulus-driven growth, cast serious doubt on the sustainability of the recovery. We are not confident that the Chinese economy is poised for a structural recovery. This is because it still relies heavily on significant policy support, and key challenges remain unaddressed, such as imbalances in the property and credit markets, issues with local government financing, and inefficient capital allocation within the economy.

Until these factors are resolved, sustainable growth in China seems most unlikely.

One Emerging Market to watch

Prima facie the Philippines is in many ways the poster child Emerging Market. The country has a population of 116 million that is growing at 1.5% per annum (double the rate of even India’s population growth) thanks to a fertility rate of 2.75, which is amongst the highest in EM.

The population is exceptionally young, with a median age of just 25.7 – by comparison to India, which is typically and correctly, praised for having strong demographic tailwinds, with a median age of 28.4.

In a world with too much debt and demographic headwinds, the Philippines is a clear standout, but the country also wins in a world where trade in goods has likely already peaked, and globalisation is in retreat.

President Marcos has pivoted away from China and tried to repair relations with the United States. Marcos will likely continue to encourage foreign direct investment (FDI) through his dual approach of friendlier relations with the West and removing red tape and protectionist regulations.

This should bode well not just for the economy, but also for the local share market which – at around 10x forward earnings – is cheap both compared to history and relative to the rosy outlook for corporate profits.

This information has been prepared by Northcape Capital, the underlying investment manager for the Warakirri Global Emerging Markets Fund.

Learn more about Northcape Capital

For more information on Northcape Capital and their funds and strategies visit their website.