Income generation is a key component of many clients’ investment portfolios particularly as they approach and enter retirement. Assets such as bonds, Real Estate Investment Trusts (REITs), mutual funds and ETFs are often employed to deliver a regular stream of income, however reporting on the income generated from each can present several challenges, including:

- Tracking and reporting on multiple income sources – Income may come from dividends, interest, rental income, and more. Tracking and accurately reporting these sources across different asset classes can be complicated, often requiring multiple reports.

- Tax Implications: Different types of income have varying tax treatments. Understanding and reporting these implications correctly is crucial for compliance and accurate performance analysis.

- Market Volatility: Changes in interest rates, economic conditions, or company performance can affect income-generating assets, complicating the assessment of portfolio stability and future income projections.

- Performance Measurement: Evaluating the performance of income portfolios often requires different metrics (e.g., yield vs. total return), making consistent reporting difficult.

Given these challenges, finding a one-size fits all approach to income reporting, that many platforms offer, can result in a shallow analysis that satisfies no-one, particularly high-net-wealth and sophisticated investors.

That’s why Praemium backs up their summary reports with the detail that makes a difference. Take a look at some of the Praemium reports that can benefit adviser decision making and make reporting for income investing a richer experience for your investors.

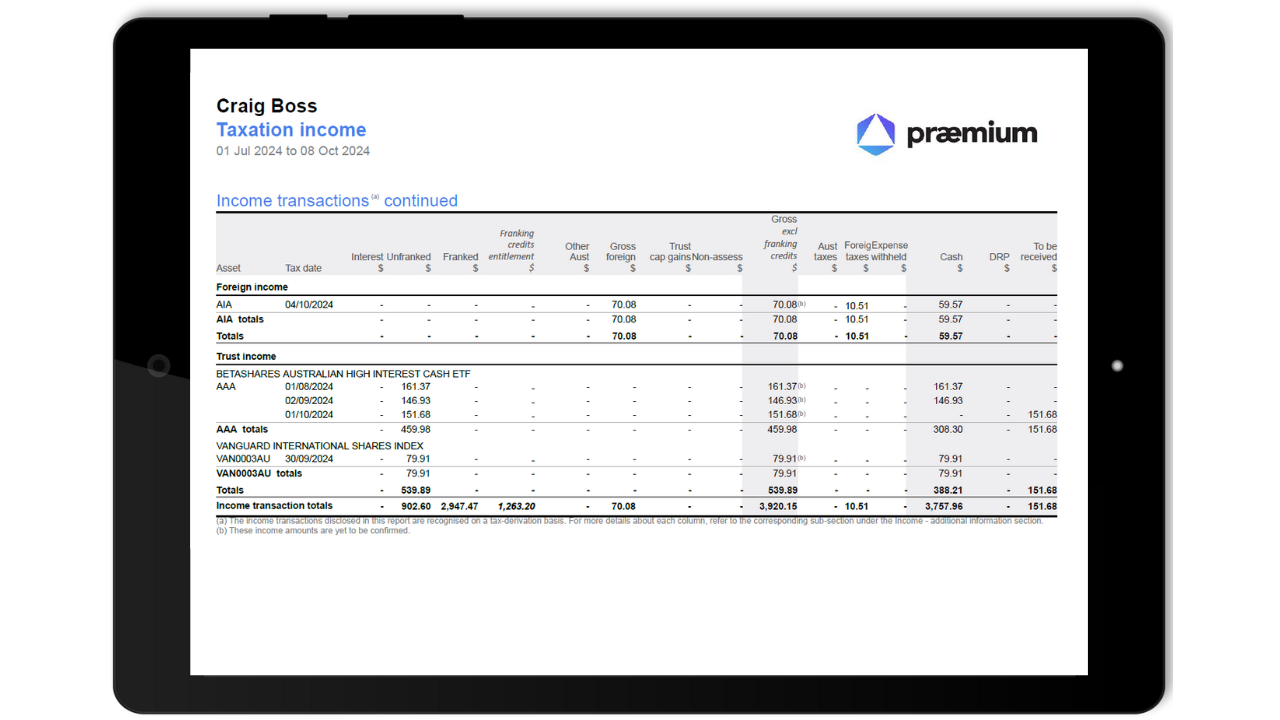

Delivering the essential detail needed for tax reporting

While the Tax Summary report is a great starting point, many accountants want more information. The Taxation Income report provides the level of detail required to understand what makes up a portfolio’s taxable income. This report comes as standard in the Praemium reporting suite, so when your client needs more information, it’s readily available without the need for extensive searching.

The report contains four parts:

- Income transactions: dividend, trust income, interest and rental income transactions

- Non-CGT gains/losses: gains or losses from the sale of traditional securities, or short sells closed, or gains/losses from exchange rate movements, or gains/losses from the maturity of forex spot and forward contracts within the financial year, all of which are treated by the ATO as income.

- Income transactions – additional information: a breakdown of some of the columns in the Income transactions section into further components.

- Income Summary: a summary of the detail with a snapshot of the source of income and a totals breakdown for the tax components.

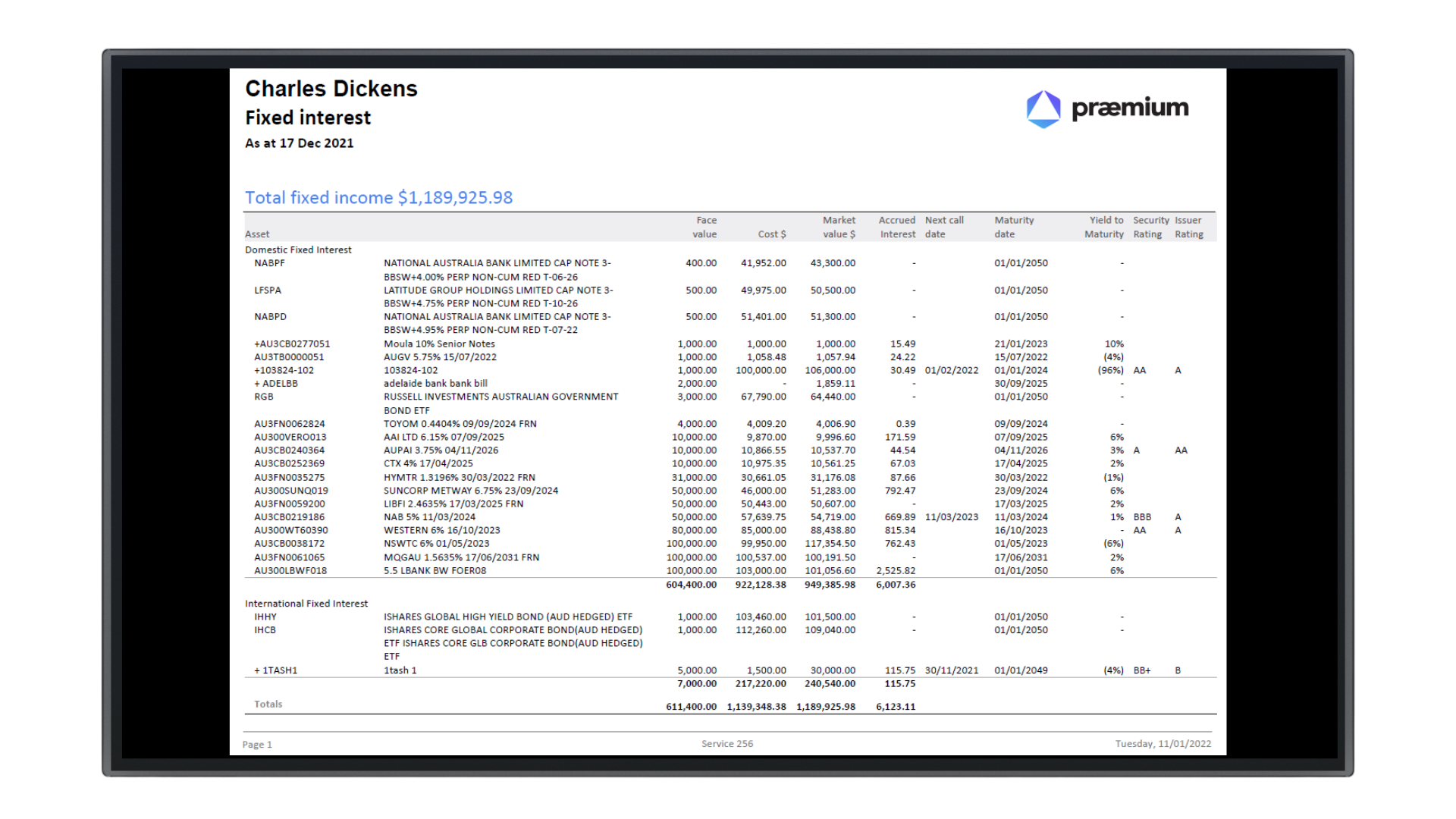

Unlocking the detail for locked-in yields

Long recognised as a solid choice for securing yields, bonds have evolved into a $100 trillion global marketplace that offer many potential benefits to investment portfolios. But this rapid evolution has come at a cost as traditional reporting platforms have struggled to keep up. Praemium’s Fixed Interest valuation report takes one-click reporting on bonds to a new level of sophistication by including comprehensive details such as next call dates, maturity dates and security and issuer ratings where available.

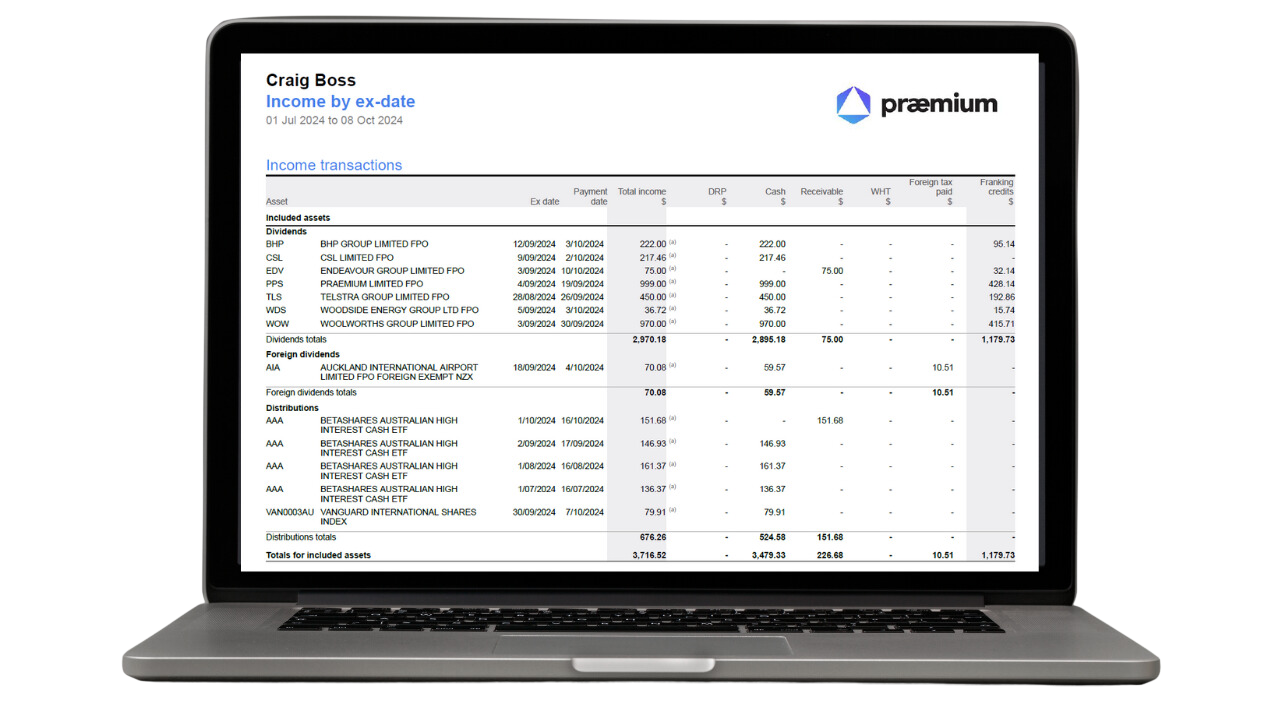

Accrual dates for accurate performance reports

The Income by ex-date report is renowned within Praemium’s suite of performance reports. This report provides the total income and tax credit breakdown for income entries that accrued within a performance period.

This report differs from our Taxation Income report because it contains tax component information and is based on income with a tax date within the period rather than year-end reporting.

The Income by ex-date report can be used to troubleshoot or reconcile income and tax credit transactions in your performance reports.

Estimating future income to support informed decision-making

The Estimated income report uses dividends/distributions paid by a company or fund in the previous 12 months to estimate income that may be paid in the next 12 months. Advisers can use this section to:

- plan their client’s income stream for the year, for example, pension payments

- demonstrate how investments held may perform compared to the current cash rate.

The report includes each estimated income payment that will occur for assets held as at the requested date, and whether it will be received in cash or reinvested. There is also an option to show/hide the chart showing estimated income for the 12 months after the report's period end date.

These reports are NOT intended to be advice

The information provided on the reports described in this article are not intended to influence any person in making a decision in relation to a particular financial product, class of financial products, or any interest in either. Taxation is only one of the matters that must be considered when making a decision in relation to a financial product. However, to the extent that advice is provided on these reports, it does not take into account any person's particular objectives, financial situation or needs. These should be considered to determine the appropriateness of the advice, before acting on it.