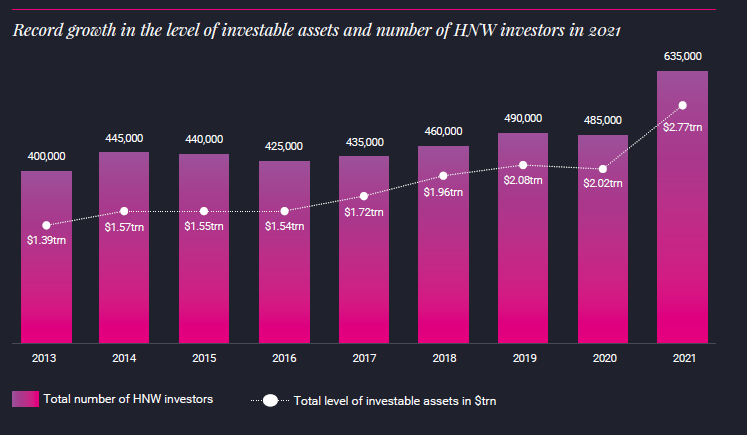

In a little over a year, the HNW sector became the fastest growing and prosperous investor segment in Australia, with investable assets surpassing $2.7tr. The sector is broad, encompassing the emerging affluent to the ultra HNW investor and, with varying complexities of investment strategies and unmet advice needs, represents a great opportunity for IFAs and Private Wealth advisers alike.

Praemium was founded in 2001 as a HNW specialist platform and our recent acquisition of Powerwrap further enhanced our market-leading position in the sector. We provide solutions to some of the largest private wealth advisory firms in Australia and over 40% of Barron’s top 100 advisors. This gives us unique insights into the investment needs of the HNW investor and we’ve outlined the key trends we’ve seen in this sector recently.

Portfolio Management Trends

Demand for Income and Term Deposits

Recent market volatility coupled with successive interest rate rises have seen an increased interest in bonds and fixed income solutions from HNW advisers, particularly non-investment grade bonds. In the hunt for income, investors moved up the risk curve and are now opting to offset market volatility and remove the relatively high-risk premium of a low-return equity environment. For the first time in a long time, there has also been increasing interest in cash and term deposit products specifically. Product providers are now reaching out to Private Wealth firms to capture this demand opportunity early.

The rapid adoption of Alternatives

Recent research from Ernst and Young highlighted that across the full spectrum of HNW investor segments, investors are seeking greater portfolio diversification and sourcing an increased number of product types to deliver this, including assets with low correlations to traditional markets. One-third of HNW clients currently invest in alternatives, namely hedge funds, private markets, real estate, infrastructure, commodities and digital assets, such as cryptocurrencies. This figure is predicted to reach 48% by 2024. Since 2018, Praemium has seen investment in alternatives double through HNW advisers using our platform, a growth trend that has continued even with the market corrections of late.

Unmet advice needs

While many HNW advisory firms place portfolio construction at the forefront of their Client Value Proposition, investors are increasingly confident they can make their own investment decisions, with 52% stating they would only seek advice to validate their decisions. HNW investors acknowledge they have unmet advice needs with 60% rating inheritance, estate planning and reducing tax obligations as the key areas they need advice. It is important for advisory firms targeting this segment to build a narrative that describes how all advice needs are catered for, not just the portfolio management aspect of a client-adviser relationship.

Platform needs of the HNW Adviser and Investor

Enhanced Client Engagement

With 50% of HNW investors believing their adviser should have a digital engagement model, it is not surprising that many HNW advisory firms using Praemium are seeking ways to provide a deeply integrated, highly personalised experience. Whilst scalable investment and portfolio management solutions provide significant business efficiency gains, they can remove the sense of a bespoke adviser-client relationship. We are seeing advisers use Praemium’s custom benchmarking and asset allocation tools to deliver information in a way that is tailored and meaningful to their investors. This can help create the hyper-personalised experience that the HNW segment expects, particularly when it is delivered via their own digital Investor Portal.

A single view of wealth

Investment Trends' latest HNW investor survey showed that 68% of advised HNW investors believe it is important to have a single view of wealth*. Praemium has seen an increased interest in HNW advisory firms wanting to be the central source of data for their clients, even though they may not manage all the wealth of an investor or family group. They are therefore sourcing ways to share data across multiple services within the Praemium platform. This will be an increasing part of the value proposition as the average HNW investor has just over half (56%) of assets managed by their preferred adviser, opting to select specialist managers for segments of their portfolio to reduce the risk of having all assets with one adviser.

Investment Diversification

Platforms must cater to portfolio management trends and provide access to the diverse range of investment opportunities that advisers and their clients demand, both liquid and illiquid, custody or non-custody. In addition to the need to deliver on the increasing demand for alternatives, platforms also need to be able to communicate or partner with a growing number of alternative investment platforms, which are reducing scale restrictions for smaller balances. To do so requires a sophisticated API solution which is a significant disadvantage of the more traditional retail platform in Australia.

In summary, the rapid growth in the number of HNW investors offers significant opportunities for advisory groups servicing this sector. HNW advisory firms will need to build portfolio management methodologies and dynamic client engagement models that can deliver a client value proposition that meets the changing needs of HNW investors. Leveraging the right specialist platform technology will be key to ensuring this is done efficiently and successfully.

*Source for all data unless otherwise stated: Investment Trends HNW Investor Survey 2021.