What does your portfolio’s CGT and performance look like?

Whether you are checking capital gains and performance, or pulling together information for your clients’ annual tax returns, our technology makes your year-end more accurate and less time consuming.

Stay a step ahead on capital gains

As we approach the tax reporting season, many advisers and accountants are already checking their client’s tax position.

With Praemium's What If Trading Analysis you can review the impact of potential trades on a portfolio’s net capital gain, along with any corresponding impact on the portfolio’s estimated income for the next 12 months.

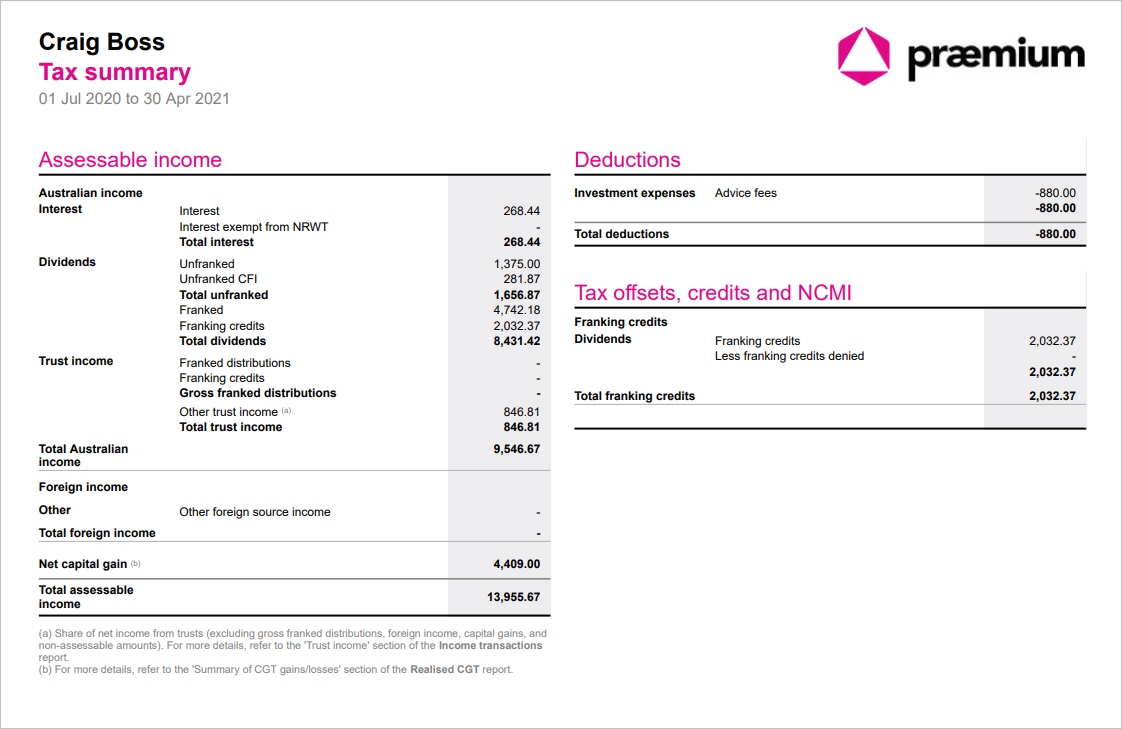

Simple and fast, tax ready reporting

Giving you the overall CGT gain or loss for a portfolio, the Tax Summary Report report is designed to be all you need to submit a tax return.

And our super handy Investor Tax Summary Guide matches all the numbers in the report to the ATO’s tax return form.

Easy to consume performance reporting

End of year is not just all about tax. For investors, it’s a common time for reflection on just how well their investments have performed. As financial advisers, you’re looking for tools that can help to communicate this.

Using your own branding, our Infographic Portfolio Summary shows a portfolio’s performance at a glance. Out-of-the-box, this is just the type of easily-consumed yet informative report that many of your clients have been asking for.

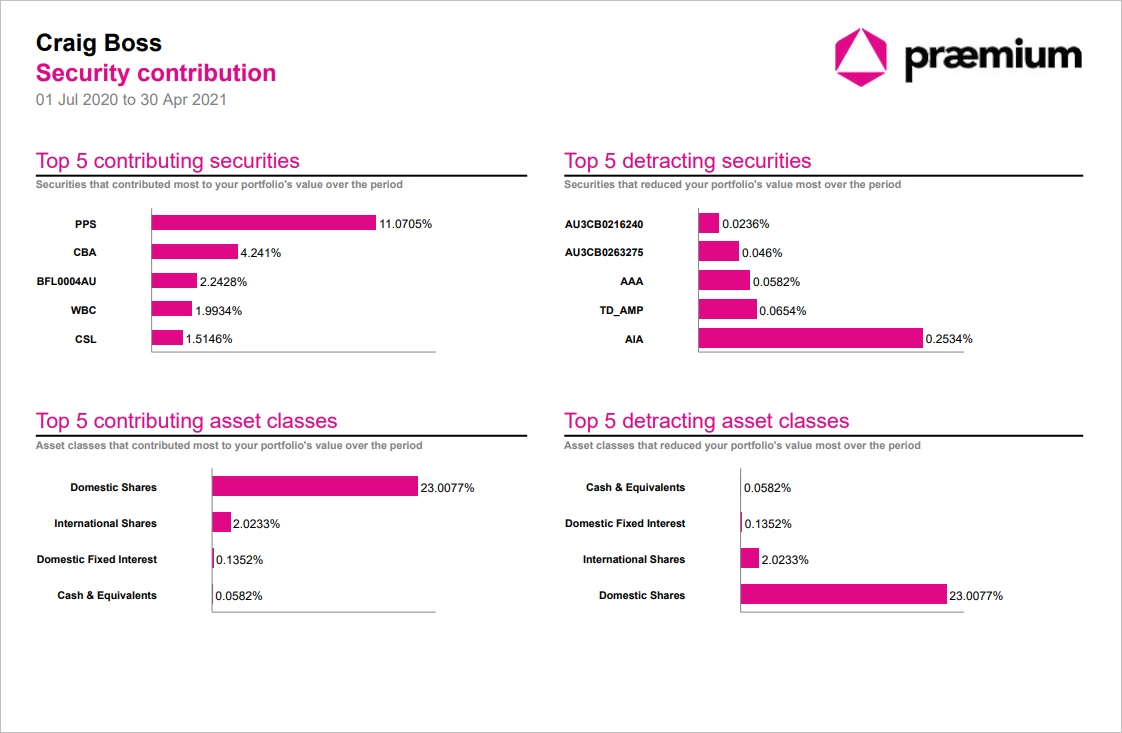

Performance & income contribution by security

For many of today’s investors, a performance return figure is not enough. They want to see the percentage contribution of each security towards the portfolio's total performance returns.

With a great summary page showing the best and worst performers, backed up by additional pages with all the corresponding detail, our Security contribution report was designed to meet this need.

DIY custom reporting

If you can’t find what you need in our reporting suite, why not build your own?

Praemium’s dynamic Report Data Library gives you the power to generate your own reports, by combining your words and branding with a huge range of facts, figures and charts that you can drag and drop directly from your client's portfolio.

Our automation helps get it right

Accurate EOFY reporting requires accurate portfolio data. Praemium’s advanced portfolio reconciliation technology is the safety net that helps you catch a problem before it becomes a bigger one.

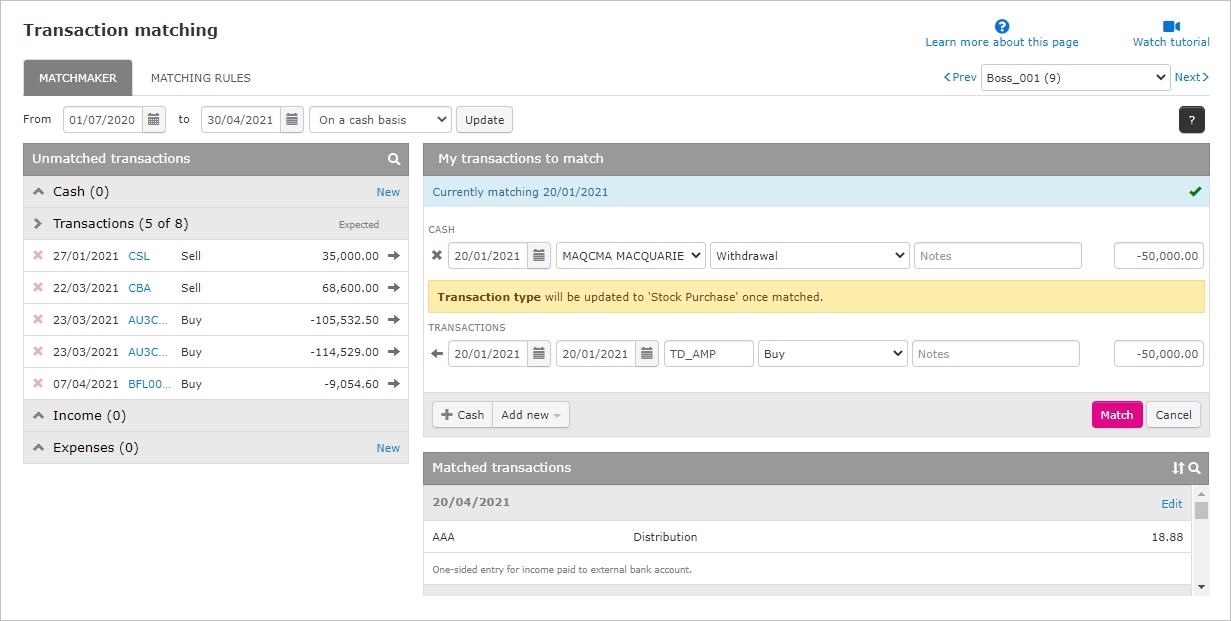

Automatically finding missing transactions

Finding and resolving any missing transactions is key to providing accurate performance and tax reports.

Praemium’s Transaction Matching functionality reconciles your clients’ buys and sells, dividends and other corporate actions every day against the money coming in and out of their trading accounts.

Giving you the peace of mind your portfolio's are always balanced.

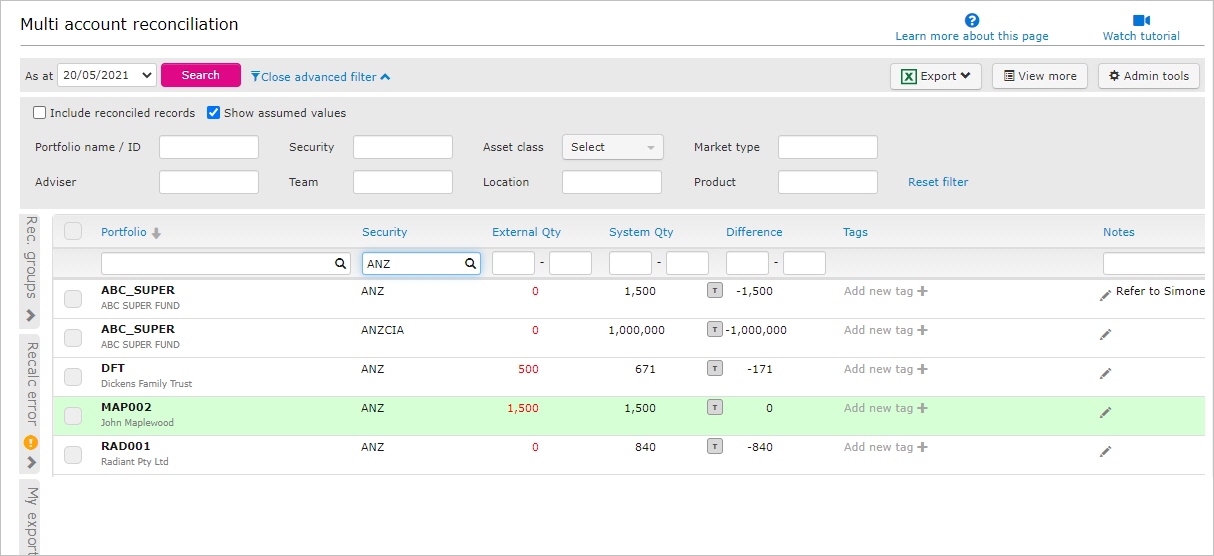

Double checking your balances and holding quantities

Praemium's Multi Account Reconciliation automatically compares holding quantities and cash balances in your portfolios, with those provided by an external data feed.

Get a service-wide look across all your portfolios to see if there are differences between what the platform says your clients have and what your brokers, banks and registries say they have.

Helping you through the tax season

Come the end of year, we understand many investors are anxious to submit their tax returns and this can create a lot of noise for their advisers. As we all know, trust distributions are not always finalised when we want them to be. Praemium assist with year-end tax reporting requirements by updating final tax component information for trust distributions received during the financial year, based on information made available by the trust or fund manager.

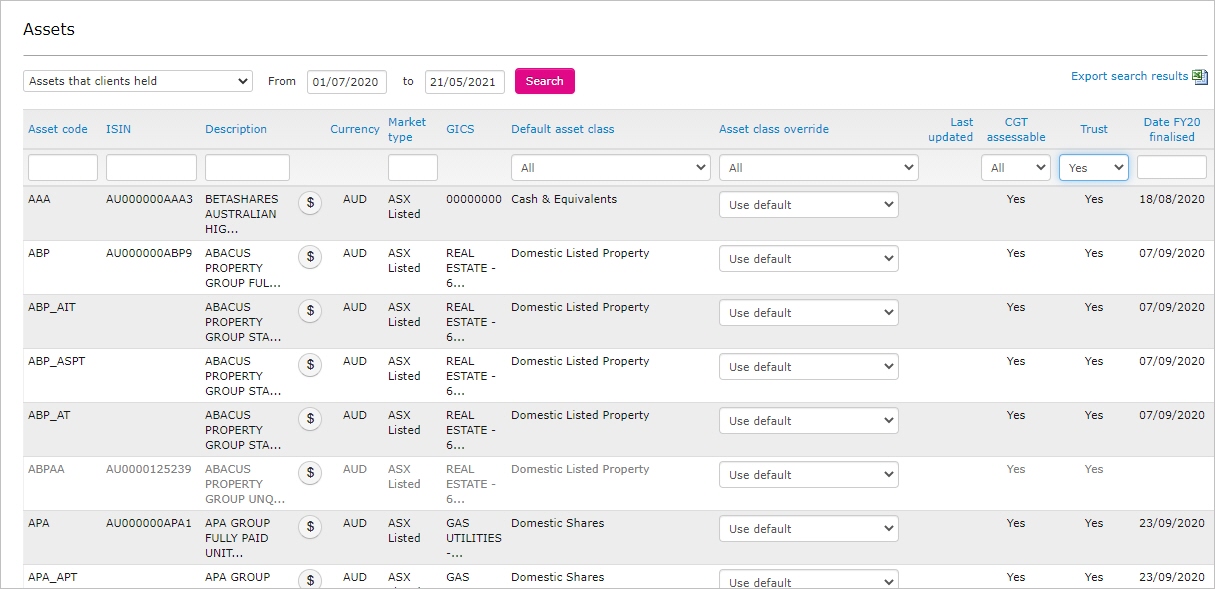

All your clients’ assets in one screen

Our Assets screen contains all assets that were held by your clients in a financial year, and gives you the power to quickly sort assets by those trusts whose distributions have or have not been finalised.

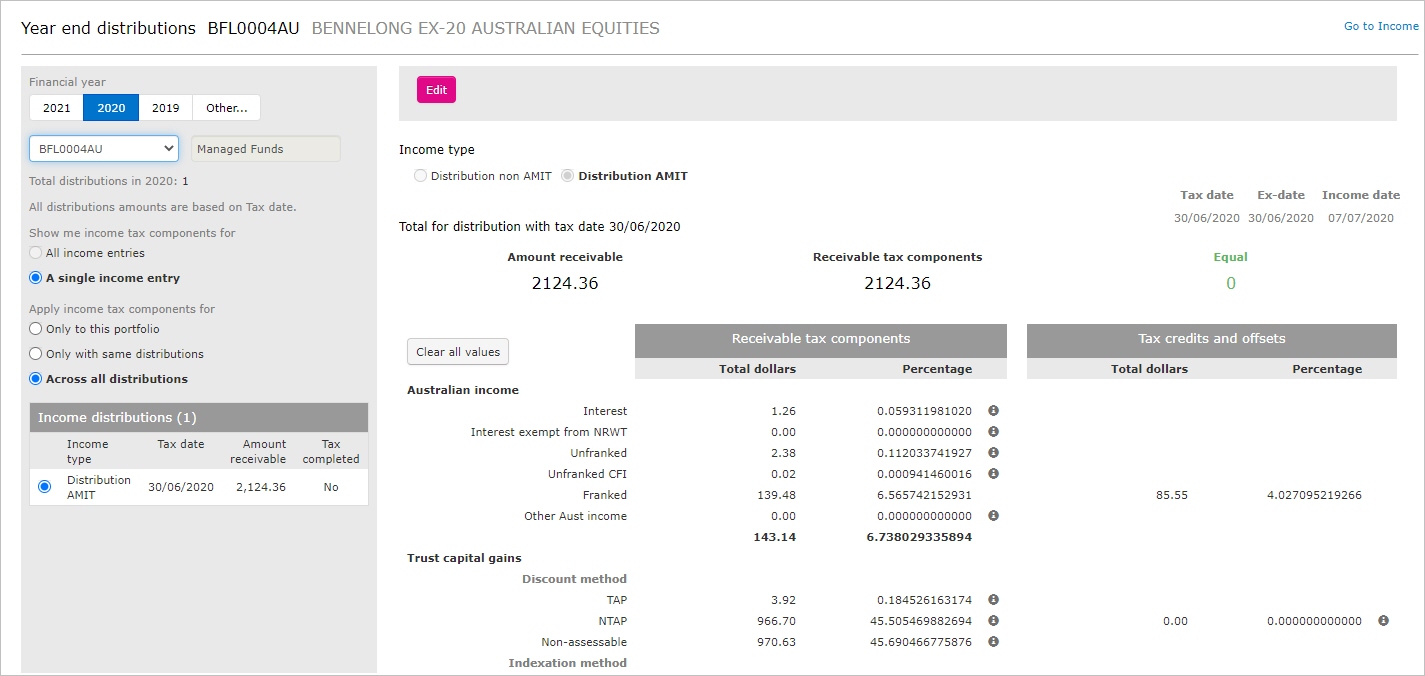

Full tax component breakdowns for listed trusts

If you want to review the complete tax component breakdown for all listed trusts, stapled securities and managed funds within a financial year, then the Year End Distributions screen is the place to go.

It shows you when a distribution has been finalised and you can even edit the components and apply the new treatment to all other portfolios that hold the same asset.

We are with you each step of the way

Each year we update and publish key dates and handy guides that can help you through the end-of-financial-year reporting season. Take at a look at our getting ready for tax-year end page where you will find a bunch of related information, including critical SuperSMA processing dates and updates on our EOFY investor communications, statements and tax reports.

Finally, our support teams are always just an email or phone call away and are keen to help you through your reporting season, regardless of how simple or complex your questions may be.